In the U.S., total bankruptcy filings rose by 10.6 % in the 12 months ending September 30, compared to the previous year. The increase is driven largely by nonbusiness (i.e. personal/consumer) filings (10.8 %) but note that a substantial amount of the filings are business related (5.6%).

In the Northern District of California, Oakland Division Bankruptcy Court (covering Alameda and Contra Costa Counties) reported that its “Grand Total” bankruptcy filings were the lowest in 2022, then rose by 29.3% in 2023, 21.7% in 2024 and is up 12.1% year to date in 2025. To break that down, Chapter 7 filings are up 19.5% from 2024, in 2024 the filings were up 22.1% from 2023 and in 2023 they were up 35% from 2022. As a comparison, Chapter 13 filings are actually down 3% from 2024, in 2024 the filings were up 25.5% and in 2023 they were up 17.7%.

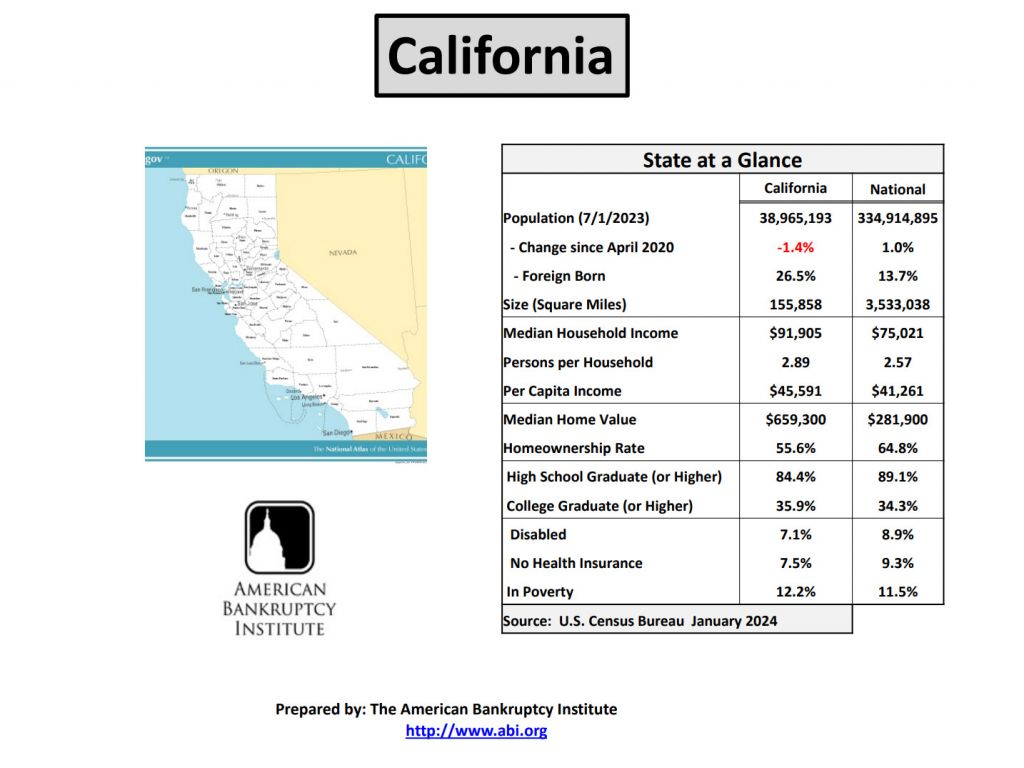

In 2024, California led the nation in number of bankruptcy filings with ~47,621 total filings (all types), though this is a raw count, not per-capita. All of this data suggests that, yes, bankruptcy activity in California is trending upward.

the increases in filings However have not eclipsed past peaks (e.g. pre-pandemic levels) in many jurisdictions.

During the post-recession years of 2010 and 2011, the bankruptcy filings were at their high point. From 2011 to 2022 there was a steady decline each and every. Now the trend is reversing. Although the increases that last few years look like big jumps, they are actually small steps back to more normal bankruptcy filing numbers. From 2011 to 2022 the number of bankruptcy filings dropped by 90% so the recent increases are merely increases from a very low filing number.

Note that some federal bankruptcy districts in California may see stronger increases than others; local economies, cost of living, and debt burdens differ. Economic stressors (e.g. inflation, interest rates, housing costs) may take time to translate into filings, so some of the increase may be catching up with earlier pressures.

If you have questions about the trends in bankruptcy filings, call David A. Arietta at (925) 472-8000.